| |

|

|

|

|

|

| |

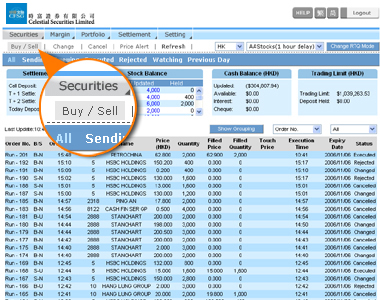

Buy/Sell Order |

| |

| |

|

|

|

| Click "Buy/Sell", and choose "Buy" or "Sell". Enter the "Stock code", "Price", and stock "Quantity" that you would like to trade, then press "Submit". If necessary, clients are able to set special order functions, for instance, "Target price buy order", "Limit price buy order", "Stop gain sell order", "Stop loss sell order" and "Market open" order. |

|

|

|

| |

|

|

|

|

| |

Target Price Buy Order |

| |

| |

|

|

|

Please click "Buy" and choose "Target Price Buy Order" and choose "Target Price Buy Order" , then enter "Touch Price" , then enter "Touch Price" . .

Target Price Buy Order:When stock price goes up and reach the designated "Touch Price", target price buy order will be sent to the market at the "Order Price".

Touch Price:When this market price of the stock hits this touch price, the order will be sent to the Stock Exchange for matching.

Example:Current stock price is $90, if client sets up a target price buy order, which "Order Price" and "Touch Price" are "$100" and "$99.5" respectively. When nominal price of the stock goes up and reaches $99.5, buy order will be sent to market at $100. |

|

|

|

| |

|

|

|

|

| |

Limit Price Buy Order |

| |

| |

|

|

|

Please click "Buy" and choose "Limit Price Buy Order" and choose "Limit Price Buy Order" , then enter "Touch Price" , then enter "Touch Price" . .

Limit Price Buy Order:When stock price drops to the designated "Touch Price", limit price buy order will be sent to the market at the "Order Price".

Touch Price:When this market price of the stock hits this touch price, the order will be sent to the Stock Exchange for matching.

Example:Current stock price is $110, if clients sets up a limit price buy order, which "Order Price" and "Touch Price" are "$100" and "$99.5" respectively. When nominal price of the stock drops to $99.5, buy order will be sent to market at $100. |

|

|

|

| |

|

|

|

|

| |

Stop Loss Sell Order |

| |

| |

|

|

|

Please click "Sell" and choose "Stop Loss Sell Order" and choose "Stop Loss Sell Order" , then enter "Touch Price" , then enter "Touch Price" . .

Stop Loss Sell Order:When stock price drops to the designated "Touch Price", stop loss sell order will be sent to the market at the "Order Price".

Touch Price:When this market price of the stock hits this touch price, the order will be sent to the Stock Exchange for matching.

Example:Current stock price is $110, if client sets up a stop loss sell order, which "Order Price" and "Touch Price" are "$99.5" and "$100" respectively. When nominal price of the stock drops to $100, sell order will be sent to market at $99.5. |

|

|

|

| |

|

|

|

|

| |

Stop Gain Sell Order |

| |

| |

|

|

|

Please click "Sell" and choose "Stop Gain Sell Order" and choose "Stop Gain Sell Order" , then enter "Touch Price" , then enter "Touch Price" . .

Stop Gain Sell Order:When stock price goes up and reaches the designated "Touch Price", stop gain sell order will be sent to the market at the "Order Price".

Touch Price:When this market price of the stock hits this touch price, the order will be sent to the Stock Exchange for matching.

Example:Current stock price is $90, if client sets up a stop gain sell order, which "Order Price" and "Touch Price" are "$99.5" and "$100" respectively. When nominal price of the stock goes up and reaches $100, sell order will be sent to market at $99.5. |

|

|

|

| |

|

|

|

|

| |

Good till date |

| |

| |

|

|

|

| Clients are able to set the expiry date in which is up to the coming 4th Friday from today. |

|

|

|

| |

|

|

|

|

| |

Market Open |

| |

| |

|

|

|

| Upon clicking the "Market Open" box, the order will be held and then passed to the AMS of SEHK by the time that the market opens after 09:30 a.m. |

|

|

|

| |

|

|

|

|

| |

Fill and Kill (FAK) |

| |

| |

|

|

|

Choose "Buy" or "Sell" , then click "FAK" , then click "FAK" . Enter the "Stock code", "Price", and stock "Quantity" . Enter the "Stock code", "Price", and stock "Quantity" that you would like to trade, then press "Submit". that you would like to trade, then press "Submit".

A Fill and Kill (FAK) order means that the order is to be matched immediately after submission, as much as possible, up to quantity specified in the Qty field and the remaining unmatched portion, if any, of the order will be cancelled automatically by the system at once.

The order will be executed when the prevailing market price is exactly the same as the price you set. FAK for Hong Kong market will only be accepted during Hong Kong Stock Exchange trading hours (09:30 a.m. - 12:00 p.m. and 1:00 p.m. to 4:00 p.m. HKT).

Note:"FAK" cannot be used in conjunction with "Good till Date", "FOK" and "AO" orders.

|

|

|

|

| |

|

|

|

|

| |

Fill-or-Kill (FOK) |

| |

| |

|

|

|

Choose "Buy" or "Sell" , then click "FOK" , then click "FOK" . Enter the "Stock code", "Price", and stock "Quantity" . Enter the "Stock code", "Price", and stock "Quantity" that you would like to trade, then press "Submit". that you would like to trade, then press "Submit".

A Fill-or-Kill (FOK) order is to be matched immediately after submission at the exact quantity specified in the Qty field or else it will be totally cancelled automatically by the system at once.

The order will be executed when the prevailing market price is exactly the same as the price you set. FOK for Hong Kong market will only be accepted during Hong Kong Stock Exchange trading hours (09:30 a.m. - 12:00 p.m. and 1:00 p.m. to 4:00 p.m. HKT).

Note:"FOK" cannot be used in conjunction with "FAK" and "AO" orders.

|

|

|

|

| |

|

|

|

|

| |

Auction Order (AO) |

| |

| |

|

|

|

Choose "Buy" or "Sell" , then click "AO" , then click "AO" . Enter the "Stock code" and stock "Quantity" . Enter the "Stock code" and stock "Quantity" that you would like to trade, and then press "Submit". that you would like to trade, and then press "Submit".

An at-auction order is an order with no specified price. It enjoys a higher order matching priority than a limit order. It will be matched in time priority at the final IEP in Pre-opening Session or the closing price in the closing Auction Session.

Any outstanding at-auction orders after the end of the Pre-opening Session will be cancelled before the commencement of the Continuous Trading Session.

Pre-opening Session

| Order Input Period |

9:00 am - 9:15 am |

| Pre-order Matching Period |

9:15 am - 9:20 am |

| Order Matching Period |

9:20 am - 9:28 am |

| Blocking Period |

9:28 am - 9:30 am |

Closing Auction Session

| Period |

Full Day Trading |

| Ref. Price Fixing |

4:00pm - 4:01pm |

| Order Input |

4:01pm - 4:06pm |

| No Cancellation |

4:06pm - 4:08pm |

| Random Closing |

4:08pm - 4:10pm |

|

|

| Half Day Trading |

| 12:00pm - 12:01pm |

| 12:01pm - 12:06pm |

| 12:06pm - 12:08pm |

| 12:08pm - 12:10pm |

|

Note:"AO" can only be used in conjunction with "Manual Order".

|

|

|

|

| |

|

|

|

|

| |

Market Order |

| |

| |

|

|

|

Choose "Buy" or "Sell" , then click "Market Order" , then click "Market Order" . Enter the "Stock code" and stock "Quantity" . Enter the "Stock code" and stock "Quantity" that you would like to trade, and then press "Submit". that you would like to trade, and then press "Submit".

A Market Order is an order to buy or sell a stock at the market price. You do not need to set a limit price and the order will be executed at best available market price at time of execution.

Note:"Market Order" can only be used in conjunction with "Market Open", "FAK" and "FOK" orders.

|

|

|

|

| |

|

|

|

|

| |

Manual Order |

| |

| |

|

|

|

Choose "Buy" or "Sell" , then click "Manual Order" , then click "Manual Order" . Enter the "Stock code", "Price", and stock "Quantity" . Enter the "Stock code", "Price", and stock "Quantity" that you would like to trade, then press "Submit". that you would like to trade, then press "Submit".

|

|

|

|

| |

|

| |

|

|

|

"Manual Order" is different from other automatic orders. This buy/sell manual order will be saved at CASH trading system once submission. The order will not be sent to the market unless you choose "Change" order, then select the "Order No." order, then select the "Order No." and click "Activate" and click "Activate" it. it.

Note:"Manual Order" can only be used in conjunction with "Market Open", "FAK", "FOK" and "AO" orders. |

|

|

|

| |

|

|

|

|

| |

Save Trading Password |

| |

| |

|

|

|

| Clients are able to enter the trading password once in order to bypass entering it for placing new order, change order, and cancel order. This function can also be found at login session. |

|

|

|

| |

|

|

|

|

| |

Change Order |

| |

| |

|

|

|

Click the number of order that you would like to change, then fill in the order information, trading password and submit. that you would like to change, then fill in the order information, trading password and submit. |

|

|

|

| |

|

|

|

|

| |

Cancel Order |

| |

| |

|

|

|

| Click here and select the order that you would like to cancel, then fill in the order information, trading password and submit. |

|

|

|

| |

|

|

|

|

| |

Grouping |

| |

| |

|

|

|

| The "Grouping" function enables you to follow the record of order that has ever been changed. Click here to Display or Hide Grouping. |

|

|

|

| |

|

|

|

|

| |

Price Alert |

| |

| |

|

|

|

Click "New Alert" , and enter stock code , and enter stock code , alert price , alert price , phone number , phone number , language , language and expiry date and expiry date , then press "submit" , then press "submit" . .

Clients are able to redeem 50 Price Alert with 10 bonus alerts by paying HK$38 or 1,000 CASH Points. |

|

|

|

| |

|

|

|

|

| |

Change RTQ Mode |

| |

| |

|

| |

|

|

|

| Click here to select the display mode of RTQ, clients may choose to display it at the same window, or at a new opened window. |

|

|

|

| |

|

|

|

|

| |

Display Adjustment |

| |

| |

|

|

|

| Press "Up" and "Down" here to adjust the suitable height for displaying the platform. |

|

|

|

| |

|

|

|

|

|

|

|

|